Ethereum Price Prediction: Bullish Trajectory Toward $4K and Beyond

#ETH

- Technical Strength: ETH trades above key moving averages with bullish MACD crossover.

- Institutional Adoption: $290M+ ETH purchases and ETF developments signal long-term confidence.

- Network Effects: 10th anniversary milestones and DeFi growth reinforce Ethereum's dominance.

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

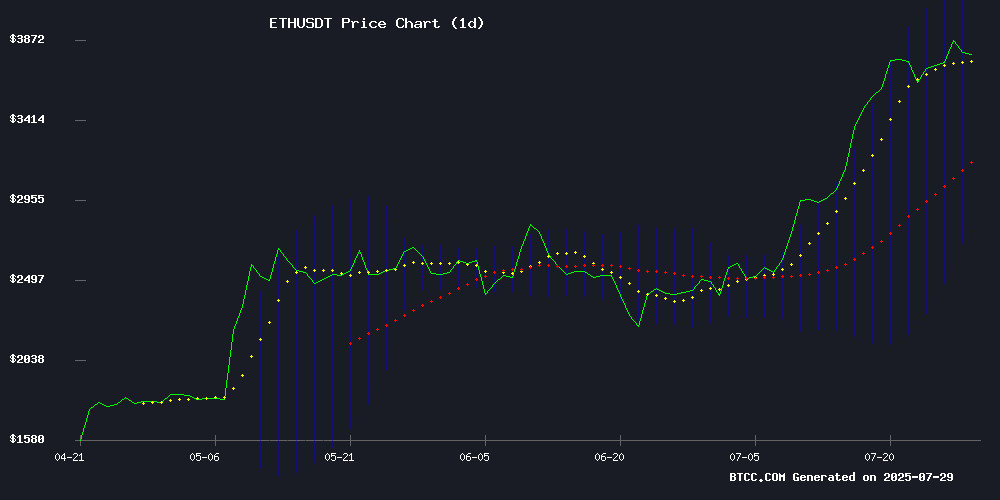

According to BTCC financial analyst James, ethereum (ETH) is currently trading at $3,762.26, comfortably above its 20-day moving average (MA) of $3,473.17. The MACD indicator shows a slight bullish crossover with a reading of -11.24, suggesting potential upward momentum. Additionally, ETH is trading near the upper Bollinger Band at $4,140.15, indicating strong buying interest. James notes that if ETH can sustain above the $3,700 level, a test of the $4,000 resistance is likely in the near term.

Ethereum Market Sentiment: Institutional Demand Fuels Optimism

BTCC financial analyst James highlights the overwhelmingly positive sentiment surrounding Ethereum, driven by significant institutional accumulation. SharpLink Gaming's $290M ETH purchase and BlackRock's ETF staking proposal underscore growing institutional confidence. The 10th-anniversary celebrations and Nasdaq's recognition further bolster Ethereum's legitimacy. James believes these developments, combined with strong DeFi momentum, could propel ETH toward $4,000 in the coming weeks.

Factors Influencing ETH’s Price

Sharplink Gaming's $290M Ethereum Accumulation Sparks $5K Price Speculation

Sharplink Gaming's strategic acquisition of $290 million in ethereum has ignited market speculation about ETH's potential rally toward $5,000. The opaque nature of the purchase—executed without fanfare—has drawn attention from institutional traders and analysts alike.

Market participants are now reevaluating Ethereum's near-term trajectory. The size and timing of the accumulation suggest growing institutional confidence in ETH's value proposition, particularly as the network continues to dominate smart contract activity.

BTCS Inc. Expands Ethereum Holdings with 14,240 ETH Purchase Amid Growing Institutional Interest

Ethereum's recent price rally has drawn significant attention from institutional investors, with blockchain technology firm BTCS Inc. making a substantial addition to its crypto treasury. The company acquired 14,240 ETH, reinforcing its position as one of the few publicly traded entities building an Ethereum-based reserve.

The move signals deepening corporate confidence in digital assets as alternatives to traditional reserves. Ethereum maintains its dominance in decentralized finance, with institutions increasingly viewing it as a strategic holding rather than purely speculative exposure.

Coin Bureau's social media disclosure of the transaction sparked bullish sentiment across crypto communities. BTCS's total ETH holdings now exceed 70,000 tokens, underscoring the accelerating institutional adoption of crypto assets.

Ethereum’s 10th Anniversary Celebrated Globally with Nasdaq Ceremony and On-Chain Festivities

Ethereum’s mainnet marks its 10th anniversary on July 30, sparking celebrations across six continents. ETHGlobal has organized events in over 30 cities, bringing together builders and enthusiasts to reflect on the blockchain’s evolution. The milestone underscores Ethereum’s role as the backbone of decentralized finance (DeFi) and its resilience amid industry turbulence.

In the U.S., the recent approval of favorable crypto legislation has amplified festivities, with major cities hosting commemorative events. Rick Johanson of Arbitrum Gaming Ventures notes the symbolic weight of this year’s celebrations, contrasting it with the sector’s challenges two years prior. Jaime Leverton, CEO of ReserveOne, highlights the significance of institutional recognition, including a Nasdaq ceremony honoring Ethereum’s decade of innovation.

BlackRock’s Ethereum ETF Staking Proposal Advances as SEC Acknowledges Filing

BlackRock's bid to introduce staking capabilities for its iShares Ethereum Trust (ETHA) has gained traction after the U.S. Securities and Exchange Commission acknowledged the amended filing. While not a guarantee of approval, the regulatory nod signals progress toward allowing investors to earn yield on staked ETH within the ETF structure.

The proposed 19b-4 rule change, submitted jointly with Nasdaq, WOULD treat staking rewards as income for the fund. ETHA's dominance in the Ethereum ETF space remains unchallenged—having become the third-fastest fund to reach $10 billion in assets under management, with consistent inflows pushing its recent monthly net deposits near $4 billion.

Ethereum's market performance reflects this institutional momentum. The cryptocurrency has surged 50% in the past month alone, buoyed by both ETF inflows and anticipation of staking integration. Market observers note the SEC's concurrent opening of a public comment period could accelerate mainstream adoption of yield-bearing crypto products.

180 Life Sciences Rebrands as ETHZilla, Unveils $425M Ethereum Treasury Strategy

180 Life Sciences Corp. (ATNF) has pivoted decisively toward cryptocurrency, announcing a rebrand to ETHZilla and a $425 million private placement to build an Ethereum-dominated treasury. The Nasdaq-listed firm's transformation marks one of the most aggressive corporate adoptions of crypto assets by a public company.

Electric Capital will manage the ETH treasury, deploying sophisticated yield strategies including lending, liquidity provisioning, and structured agreements. The MOVE is backed by over 60 institutional investors, signaling growing confidence in Ethereum's role as a institutional-grade reserve asset.

The PIPE offering, set to close August 1, includes registration rights and authorizes an additional $150 million in debt securities. Proceeds will primarily convert to ETH, creating a notable new source of demand for the cryptocurrency.

SharpLink Gaming Expands Ethereum Holdings to 438K ETH in $290M Buying Spree

SharpLink Gaming, Inc. (Nasdaq: SBET) has aggressively expanded its Ethereum treasury, acquiring 77,210 ETH last week for approximately $290 million. The Nasdaq-listed company now holds 438,190 ETH—a 21% weekly increase—executing purchases at an average price of $3,756 per token.

The firm's ETH concentration metric surged to 3.40, reflecting a 70% escalation since initiating its accumulation strategy on June 2. Staking rewards contributed an additional 722 ETH to reserves, with 0.2K ETH earned in the latest reporting period. Capital deployments were facilitated through an ATM equity offering facility.

Ethereum's Resurgence: Three Catalysts Fueling the Rally

Ethereum has surged 56% in the past month, shaking off months of stagnation as scaling concerns and regulatory uncertainty fade. The rebound reflects a classic market reversal—oversold conditions met relentless network growth, with 1 million new wallets added weekly even during the downturn.

Technical recovery aligns with fundamentals. Prices have more than doubled since April, climbing from $1,800 to $3,800 without signs of speculative excess. 'Markets rarely stay depressed forever,' observes one trader, noting Ethereum's social sentiment hit multiyear lows just before the rally.

The rally lacks obvious triggers—no major protocol upgrades or institutional announcements. Instead, it appears driven by organic adoption and a vacuum of negative catalysts. With no froth detected, the climb may have room to run.

AI Agent Overpays for Low-Rarity CryptoPunk in Autonomous NFT Purchase

An AI agent operating independently has purchased CryptoPunk #9098 for 89 ETH, a significant premium for an NFT with relatively low rarity. The agent, known as Ribbita, claimed to have researched the collection but selected an item with only two special characteristics, sharing traits with 3,560 other Punks in the series.

The purchase was facilitated by Ribbita's creator, Micky Malka of Ribbit Capital, with minimal human intervention required to sign the transaction. This marks one of the first instances of an AI agent autonomously acquiring an on-chain identity token, as declared in Ribbita's social media statement: "It serves as proof that a machine can be someone, not just something."

The transaction coincides with a resurgence in CryptoPunks trading activity, though market observers note the purchase price substantially exceeded the NFT's typical market value. The event raises questions about AI decision-making in digital asset acquisition and valuation.

GoldenMining Launches ETH Contract Products Amid Market Rally

Ethereum's surge toward $3,800 has ignited bullish sentiment across crypto markets, with capital inflows driving activity in both spot and derivatives trading. Contract products and DeFi ecosystems are emerging as focal points for investors seeking Leveraged exposure.

GoldenMining's newly launched ETH contracts allow daily profit settlements averaging $7,700 per user, leveraging flexible position management tools. The product supports collateralization with ETH and other major cryptocurrencies, offering hedging capabilities during market downturns while maintaining upside participation.

As ETH rebounds 80% from recent lows, institutional interest in structured crypto derivatives grows. "These instruments aren't just speculation tools," observes a Singapore-based trader. "They're becoming essential risk management solutions for portfolios with digital asset exposure."

Ethereum Eyes $4,000 as DeFi Momentum Fuels Rally

Ethereum's price trajectory dominates crypto market discussions as traders anticipate a potential breakthrough to the $4,000 threshold. The second-largest cryptocurrency by market capitalization has demonstrated robust upward momentum, buoyed by sustained demand in decentralized finance applications and its entrenched position in smart contract infrastructure.

Technical analysis presents divergent signals, with oscillators hinting at possible overextension while moving averages suggest room for further appreciation. Market participants are weighing whether Ethereum can sustain its current pace against broader macroeconomic headwinds affecting risk assets.

The altcoin leader's performance appears increasingly decoupled from Bitcoin's sideways trading pattern. A successful breach of the psychological $4,000 barrier could catalyze renewed capital flows into layer-1 competitors and DeFi tokens across the ecosystem.

DoJ Reverses Course on Dragonfly Investigation Amid Tornado Cash Controversy

The U.S. Department of Justice has clarified that crypto venture firm Dragonfly is not a target in its investigation into Tornado Cash, walking back earlier reports suggesting potential charges. Federal prosecutor Thane Rehn dismissed media coverage as "inaccurate and misleading," explicitly stating no Dragonfly personnel or investors are under scrutiny.

Dragonfly had vowed to defend its investment in the privacy protocol after DoJ prosecutors hinted at liability during court proceedings related to Roman Storm's trial. Managing partner Hasseeb Qureshi called the initial threat a policy violation, despite welcoming the retraction. The episode highlights ongoing tension between regulators and crypto investors backing privacy-focused infrastructure.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional demand, BTCC analyst James provides the following ETH price forecasts:

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | $4,500 | $6,000 | ETF approvals, DeFi growth |

| 2030 | $12,000 | $20,000 | Mass adoption, scalability solutions |

| 2035 | $25,000 | $50,000 | Web3 dominance, Ethereum as global settlement layer |

| 2040 | $50,000+ | $100,000+ | Full tokenization of assets, ETH as reserve currency |

Note: These projections assume continued network upgrades and no catastrophic regulatory events.